June 19, 2025 News:

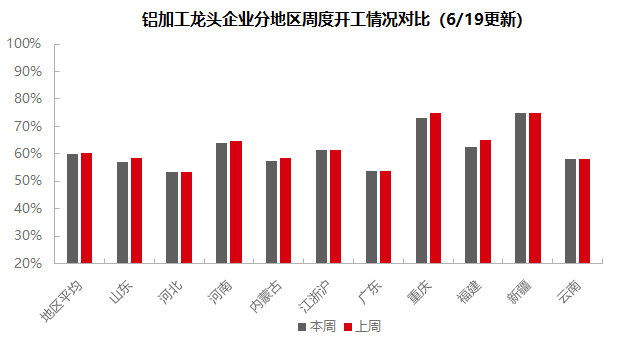

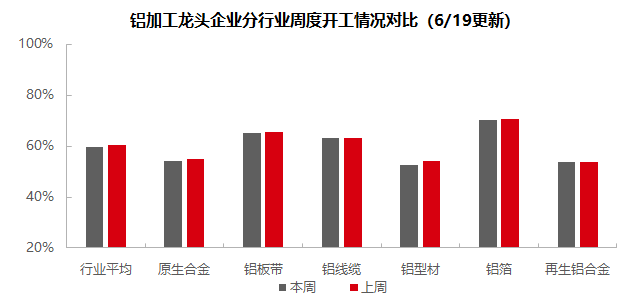

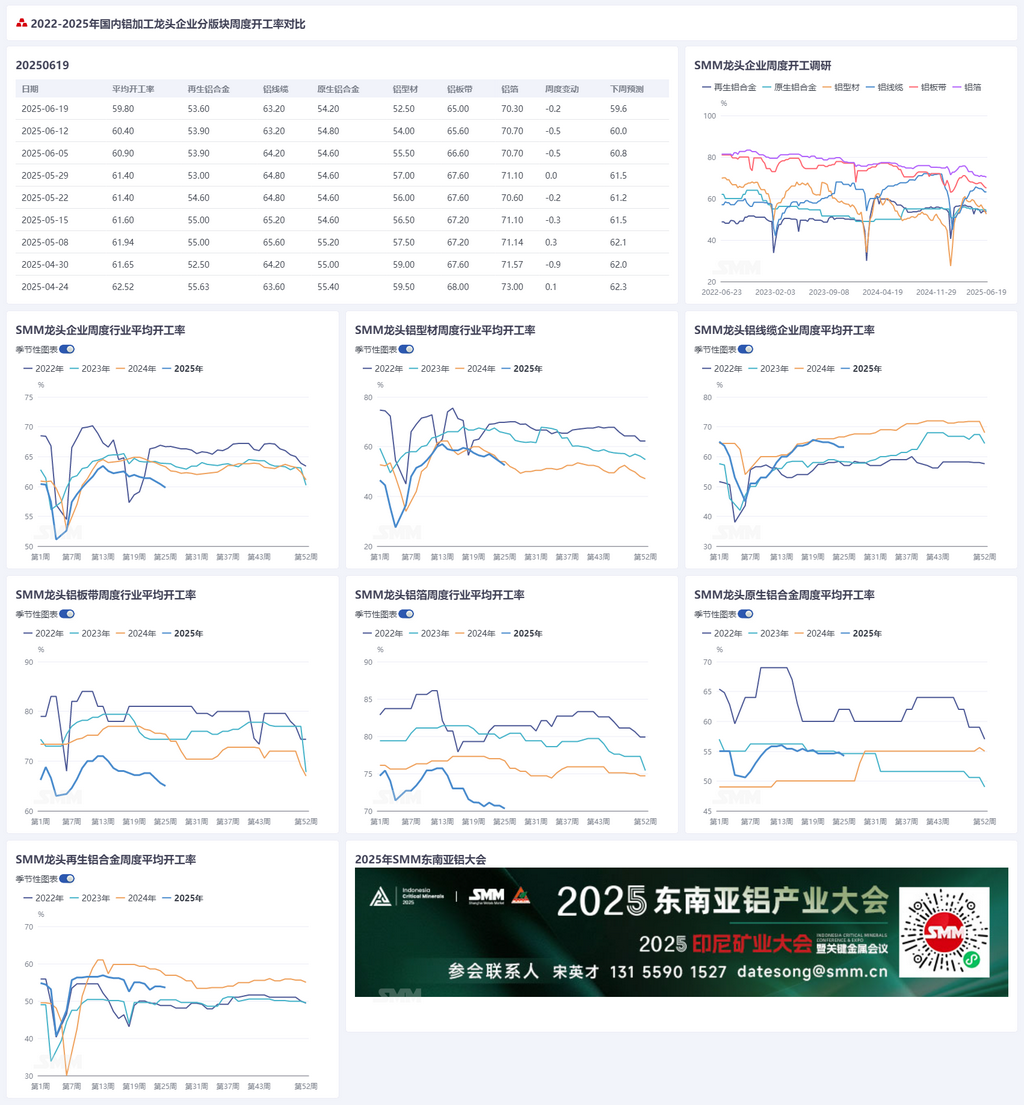

This week, the downstream aluminum processing sector is experiencing a strong off-season atmosphere, with the weekly operating rate declining by 0.6 percentage points WoW to 59.8%. By segment: Primary aluminum alloy is supported by stable demand for alloy wheel hubs, with most enterprises maintaining a cautiously optimistic attitude. Aluminum plate/sheet and strip production has declined due to high aluminum prices suppressing cargo pick-up, leading to an accumulation of finished product inventories. For aluminum wire and cable, top-tier enterprises remain stable, but small and medium-sized enterprises are affected by the State Grid's delivery cycle transition, high aluminum prices leading to losses, and profit compression, resulting in weaker operating rates. Aluminum extrusion performance is mixed, with weak new orders for building material extrusions, lower operating rates for small and medium-sized enterprises in PV frame production, and large orders in the automotive and rail transit sectors supporting billet production for industrial extrusions, though deep processing and new orders are weak. Aluminum foil production has slightly declined due to low processing fees suppressing demand and destocking pressure. Secondary aluminum production has been forced to cut due to insufficient off-season orders and sustained losses. High aluminum prices suppressing consumption, weak off-season demand, inventory pressure, and losses on the cost side are the main suppressing factors. SMM expects the downstream aluminum processing sector's weekly operating rate to decline slightly by 0.4 percentage points MoM to 60.0% next week.

Primary Aluminum Alloy: This week, the operating rate of the primary aluminum alloy industry declined by 0.6 percentage points WoW to 54.2%, mainly due to sustained high aluminum prices in mid-June suppressing end-use consumption, coupled with seasonal slowdown in cargo pick-up. Notably, supported by the temporarily stable performance of the alloy wheel hub sector compared to weak expectations in both exports and domestic demand, most enterprises remain cautiously optimistic about the market outlook, with production rhythm adjustments to be dynamically followed based on order conditions. A few enterprises are maintaining production increase plans in June due to H1 full production assessments and the promotion of liquid aluminum alloying policies. Looking ahead, the industry may continue in a weak and stable pattern, with pressure from the traditional off-season and unresolved Sino-US tariffs on one hand, and the ongoing fermentation of the transmission effect of high aluminum prices on consumption on the other. Substantial recovery awaits clarification of trade policies and relief of cost-side pressure.

Aluminum Plate/Sheet and Strip: This week, the operating rate of leading enterprises in the aluminum plate/sheet and strip sector declined by 0.6 percentage points WoW to 65.0%. Aluminum prices surged strongly during the week, approaching the 21,000 yuan mark, strengthening downstream customers' wait-and-see sentiment, slowing cargo pick-up, and continuously increasing finished product inventory levels, prompting some enterprises to temporarily slow their production schedules. Despite relatively stable demand in traditional off-season consumption sectors such as domestic automotive and electronics, the continuous downturn in the construction sector is unable to offset the overall weak domestic consumption, leading to a continuous decline in the sector's overall operating rate. In summary, the continuous accumulation of finished product inventories and downstream customers' on-demand cargo pick-up may further dampen the production enthusiasm of aluminum plate/sheet and strip enterprises. It is expected that the operating rate of leading aluminum plate/sheet and strip enterprises will continue to be in the doldrums in the short term.

Aluminum Wire and Cable: This week, the operating rate of leading enterprises in the aluminum wire and cable sector stood at 63.2%, unchanged from the previous week. Despite the stable production performance of top-tier enterprises, which maintained orderly production schedules as planned, there was a noticeable weakening trend in the operating rates of small and medium-sized enterprises, indicating a less optimistic market outlook. This weak performance can be attributed to two main factors: on one hand, the State Grid has just completed a round of centralized delivery cycles. Although the industry is not short of orders, new orders have yet to be matched for delivery. On the other hand, the current spot aluminum prices are at a high level, and there is an inversion between the bid prices submitted by enterprises earlier and the spot prices, compressing profit margins and resulting in relatively insufficient willingness to produce finished products. In terms of orders, in the past week, the list of successful bidders for the joint procurement of low-voltage power cable agreement inventory in the east China and north-east China regions of the State Grid was announced, but orders involving aluminum were relatively few. With the end of the "installation rush", orders for PV alloy cables have weakened significantly, necessitating a wait for the next cycle to restart. Based on the current weakening trend of State Grid and market orders, SMM expects that the operating rate of aluminum wire and cable will remain in the doldrums in the short term.

Aluminum Extrusion: This week, the national operating rate for extrusions increased slightly by 1.5 percentage points MoM to 52.5%. In the building materials sector, the overall operating rate of sample enterprises declined compared to the previous week. According to the SMM survey, this week, top-tier enterprises in central China, south China, and east China reported that their operating rates remained almost unchanged from the previous week, benefiting from the support of their own door and window brands. However, due to the high aluminum prices, enterprises generally reported weak new orders. Meanwhile, some sample enterprises reported a temporary suspension of raw material purchases this week. The operating rate for industrial extrusions remained unchanged from the previous week. Some medium-to-large industrial extrusion enterprises in Shandong and south-west China reported receiving large orders (mainly for rail transit and automobiles) recently, with production primarily focused on billets, providing support for operating rates. However, there were relatively few orders for deep processing. Enterprises reported that low operating rates for deep processing in Shandong are a common phenomenon, with billets typically being shipped from factories to deep-processing plants near OEMs for secondary processing. Some enterprises in east China reported that OEMs now require extrusion processors to make further concessions of 3-5% on processing fees to secure their positions as suppliers, further compressing the profits of relevant enterprises. Some small enterprises in Henan reported that only integrated producers can currently withstand the processing fees, with small enterprises still experiencing weak order intake and declining operating rates. This week, the operating rates of sample enterprises for PV frame extrusions continued to diverge. Against the backdrop of high aluminum prices, the purchase sentiment of downstream module manufacturers remained insufficient. Despite some top-tier PV frame extrusion enterprises in east China, south-west China, and Hebei maintaining operating rates unchanged from the previous week due to orders on hand, SMM learned that the operating rates of small and medium-sized PV frame extrusion enterprises in Henan and east China continued to decline, with orders on hand lasting less than a week. SMM will continue to monitor the actual progress of order implementation across various sectors.

Aluminum foil: This week, the operating rate of leading aluminum foil enterprises declined slightly by 0.4 percentage points WoW to 70.7%. Despite aluminum prices remaining at highs during the week, aluminum foil products such as battery foil and brazing foil are mostly settled based on monthly average prices, which to some extent mitigates the risks associated with excessive short-term fluctuations in aluminum prices. The impact of aluminum price fluctuations is felt less intensely compared to that of aluminum plates. However, the completion rate of the primary destocking task this month has been overall satisfactory, and the looming destocking crisis has not yet been resolved. Some enterprises have chosen to slow down their production pace. It is expected that the operating rate of aluminum foil enterprises will remain in the doldrums in the subsequent period.

Secondary aluminum alloy: This week, the operating rate of leading secondary aluminum alloy enterprises declined by 0.3 percentage points WoW to 53.6%. The decrease in operating rate was mainly constrained by insufficient new orders and pressure from losses. The traditional off-season characteristics are evident, with actual market transactions weakening further compared to last week. Growth in end-user orders has been sluggish, coupled with intensified market competition due to the impact of low-priced supplies, limiting the upside room for prices. The industry as a whole is deeply mired in losses, forcing enterprises to reduce their operating levels to alleviate pressure. In the short term, constrained by weak demand during the off-season and sustained pressure on the cost side, the industry's operating rate is expected to maintain a narrow downward trend.

》Click to view SMM's aluminum industry chain database

(SMM Aluminum Team)